The world of cryptocurrencies is an exhilarating and sometimes daunting landscape, heavily reliant on the technological backbone of mining machines. These devices are essential for validating transactions and securing networks. If you’re contemplating diving into the realm of Bitcoin, Ethereum, or alternative digital currencies, understanding mining machines is crucial. This article aims to demystify the intricate web of mining operations and how to navigate your entry into this vibrant market.

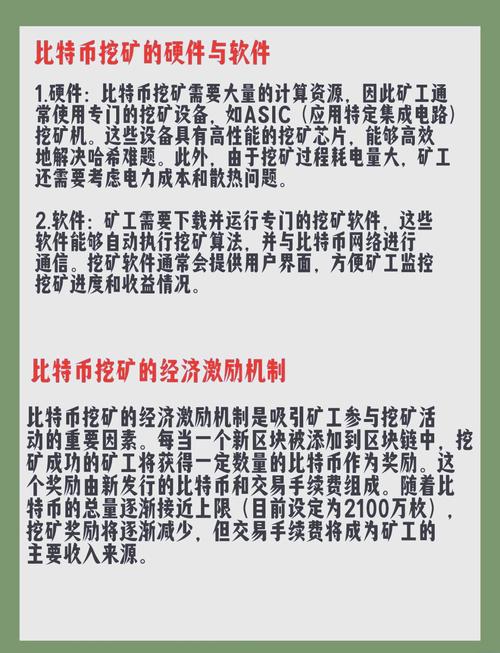

At its core, cryptocurrency mining involves using specialized hardware—mining machines—to solve complex mathematical problems. These computations are not merely academic; they serve the purpose of confirming transactions across the blockchain, a decentralized ledger that records all cryptocurrency activities. When a mining machine successfully solves a block, miners are rewarded with new bitcoins or other cryptocurrencies, which leads to the contentious issue of rewards and incentives in this highly competitive arena.

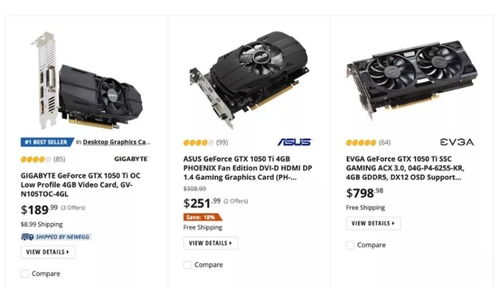

Comparing mining rigs can feel like navigating a convoluted maze, especially when considering factors such as hash power, energy efficiency, and initial investment costs. Different cryptocurrencies require different hardware capabilities; for instance, Bitcoin miners often utilize ASIC (Application-Specific Integrated Circuit) machines known for their unrivaled efficiency. On the other hand, GPUs (Graphics Processing Units) are still commonly employed for mining Ethereum and other altcoins due to their versatility and efficacy in handling multiple algorithms.

Once you’ve acquired your mining machines, hosting them effectively can significantly enhance your returns. Mining machine hosting services offer a solution for those who may not have the ideal environment to set up their operations. These facilities are specially outfitted with optimal cooling, electrical infrastructure, and security measures, allowing your rigs to operate at peak efficiency. Some companies even manage the entirety of the mining process—from hardware maintenance to power management—allowing you to enjoy the rewards without the headaches of day-to-day operation.

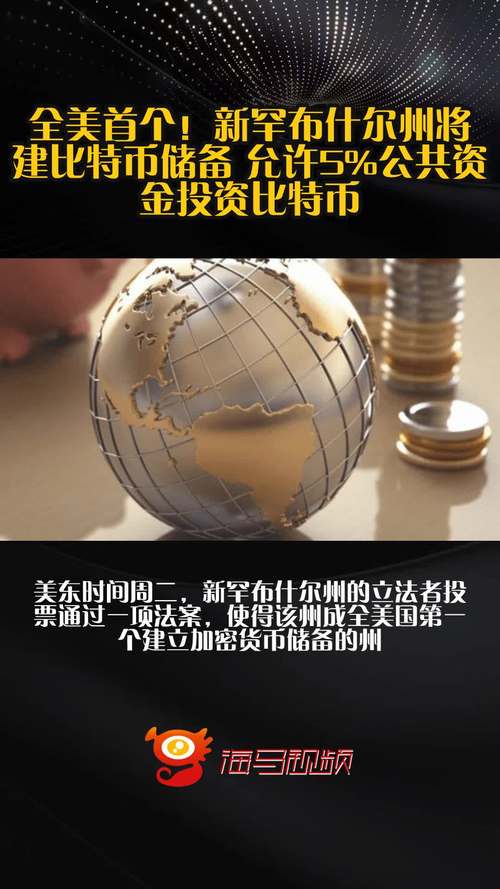

The vibrant ecosystem of exchanges where cryptocurrencies are bought, sold, and traded is deeply intertwined with mining activities. Mining not only generates new coins but also impacts market dynamics. For cryptocurrencies such as Dogecoin, a popular altcoin, a growing community of miners contributes to its valuation and acceptance. Understanding this relationship is vital for anyone looking to invest in or participate in mining activities.

The topic of sustainability is also a hot button issue when it comes to mining machines. The energy consumption of Bitcoin mining farms, for instance, has been widely debated. This necessitates discussions about renewable energy sources and innovative practices that can minimize the carbon footprint. Many custodial miners now explore geothermally powered sites or facilities located in regions with abundant renewable energy to balance profit with environmental concerns.

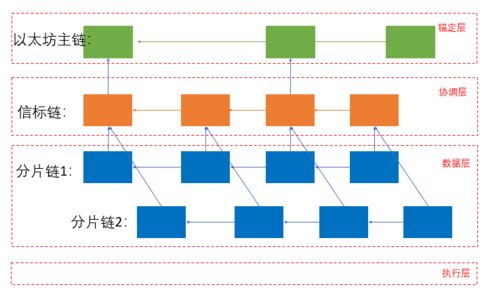

Finally, it’s essential to keep pace with industry trends as cryptocurrency continues to evolve. The transition of Ethereum from a proof-of-work system to proof-of-stake serves as a case study for how mining methodologies can shift dramatically based on consensus mechanisms. It poses questions not just about mining profitability but also about the future relevance of mining rigs as the ecosystem showcases evolution and adaptation.

To wrap up, entering the world of cryptocurrency mining can be both exhilarating and complex. Understanding mining machines, hosting solutions, and the broader impact of these operations on the ecosystem is key to becoming a successful participant in this exciting industry. As you embark on your mining journey, be prepared to adapt and grow in sync with this rapidly changing landscape. The intricacies of mining machines may seem overwhelming at first, but with thorough research and an informed approach, you can transform this challenge into a rewarding endeavor.