Imagine a world where Bitcoin isn’t just a digital currency, but the bedrock of a new financial paradigm. Now, picture the infrastructure that supports it – the humming, power-hungry Bitcoin mining farms that are the unsung heroes of the crypto revolution. Is investing in this infrastructure for 2025 a fool’s errand, or a stroke of genius? Let’s dive deep, shall we, channeling our inner Hunter S. Thompson to explore this wild frontier.

The question, as always, boils down to risk versus reward. Investing in Bitcoin mining infrastructure is akin to betting on the long-term viability of the blockchain. The potential upside is enormous: as Bitcoin’s value appreciates and transaction volumes increase, the demand for mining power will surge, translating to hefty profits for those who own the hardware and real estate. Conversely, the downside is equally significant: regulatory crackdowns, technological obsolescence, and energy cost fluctuations could all conspire to render your investment worthless. According to a recent report from the Crypto Infrastructure Consortium (CIC), “The future of Bitcoin mining is inextricably linked to the adoption rate of renewable energy sources and the ability to navigate increasingly stringent environmental regulations.” Translation? **Go green or go home.**

Let’s talk shop. Building a Bitcoin mining farm isn’t like setting up a lemonade stand. We’re talking about serious capital expenditure. You need land, industrial-grade cooling systems, a reliable power source, and, of course, the mining rigs themselves. Think of it as building a mini data center dedicated solely to solving cryptographic puzzles. The key, as with any real estate venture, is location, location, location. Look for areas with cheap electricity (ideally renewable), a cool climate (to minimize cooling costs), and favorable regulatory environments. You want to be “stacking sats” (accumulating Bitcoin) not drowning in operational expenses.

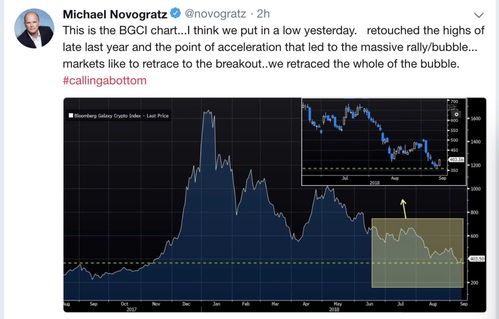

Now, let’s get real. The profitability of Bitcoin mining hinges on the difficulty of the Bitcoin network, the price of Bitcoin, and your operating costs. The higher the difficulty, the more computing power you need to solve blocks and earn rewards. The lower the price of Bitcoin, the less those rewards are worth. And the higher your operating costs, the less profit you take home. It’s a high-stakes game, a volatile cocktail of technological innovation and market speculation. Remember, this ain’t no “hodl” strategy (holding onto Bitcoin for dear life); this is active participation in the Bitcoin ecosystem.

But what about the gear? Mining rigs, or ASICs (Application-Specific Integrated Circuits), are the workhorses of the Bitcoin mining industry. These specialized computers are designed specifically for solving Bitcoin’s hashing algorithm. The market is constantly evolving, with new and more efficient ASICs being released every few months. Investing in the latest and greatest hardware is crucial, but be prepared to replace it within a few years as newer models hit the market. A 2025 study by Cambridge Centre for Alternative Finance highlights, “The efficiency gains in ASIC technology are slowing, but innovative cooling solutions and power management are becoming increasingly important differentiators.” So, keep your eye on the prize and your hand on your wallet.

Let’s not forget about the elephant in the room: regulation. Governments around the world are grappling with how to regulate Bitcoin and the crypto industry. Some are embracing it, while others are cracking down. A recent white paper by the International Monetary Fund (IMF) suggests, “A coordinated global regulatory framework is essential to mitigate the risks associated with cryptocurrency mining, particularly concerning energy consumption and environmental impact.” Keep a close eye on regulatory developments in your target jurisdiction. A sudden change in regulations could spell disaster for your mining operation.

So, is investing in Bitcoin mining infrastructure for 2025 a good idea? The answer, as always, is it depends. It depends on your risk tolerance, your access to capital, your understanding of the technology, and your ability to navigate the regulatory landscape. It’s a high-risk, high-reward venture that requires careful planning, diligent execution, and a healthy dose of luck. But for those who are willing to do their homework and play the game smart, the potential payoff could be enormous. Just remember, in the world of crypto, anything is possible. And as the saying goes, “Fortune favors the brave… and the well-informed.”

Author Introduction

Naomi Brockwell is a renowned figure in the cryptocurrency and blockchain space.

She is a policy advisor, journalist, and educator dedicated to promoting freedom and decentralization.

Naomi holds a Bachelor of Arts in Economics from Yale University and is a frequent speaker at industry events worldwide.

She also possesses a Certified Bitcoin Professional (CBP) certificate.