In the thriving ecosystem of cryptocurrency, the choice between hosted versus self-mining has become a pivotal decision for miners, particularly in a rapidly developing market like India. As Bitcoin continues its relentless ascendancy, understanding the nuances of mining operations—be it hosted services or self-run farms—holds monumental importance for prospective miners. While some might envision their own sprawling mining rig set up in a dedicated space, others see the appeal of leveraging established infrastructures for mining. In a country characterized by its vibrant technology landscape, this analysis endeavors to delve deep into the cost implications and benefits of each method.

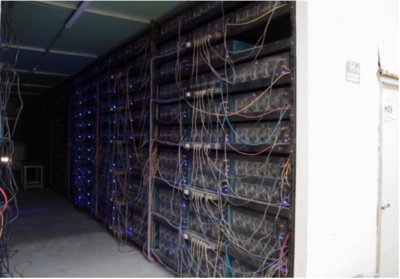

Self-mining offers several advantages, including complete control over the mining operation. This autonomy means miners can select optimized hardware configurations and adjust cooling and power supplies based on their specific requirements. Moreover, as miners, individuals have the potential to reap the full rewards generated from their mining efforts, without having to share profits with hosting providers. However, the challenges that come with self-mining can be significant. High initial costs for equipment—think extravagant setups of ASIC miners—often leave newcomers deterred. When one considers the volatile nature of Bitcoin’s price, along with fluctuating operational costs such as electricity and maintenance, it becomes apparent that self-mining is not for everyone.

In contrast, hosted mining presents a practically appealing alternative, especially for those unfamiliar with the intricate workings of cryptocurrency operations. Hosting services manage the hardware, electricity, cooling systems, and technical troubleshooting, allowing miners to bypass a significant learning curve. For those situated in areas with unreliable power supply or exorbitant electricity costs, the predictability of a hosting contract can be a lifeline. Hosted mining has exploded in popularity, especially with mining farms springing up in regions where electricity is inexpensive, effectively optimizing profit margins for all parties involved.

But let’s delve into the number crunching. When comparing costs, one must look beyond the price of the mining rig or rental fees alone. A self-mining operation incurs costs like hardware depreciation, maintenance, electricity costs which can fluctuate wildly especially in the Indian context, and the opportunity cost of time spent managing the mining setup. Conversely, hosted solutions often come with clear, transparent pricing structures. Yet, those fees might dent the overall profitability, especially as pool payments are deducted from the rewards earned. Finding that balance is crucial for any prospective miner, understanding that the appeal of each choice oscillates with personal circumstances.

Furthermore, the geographical and infrastructural landscape in India plays a critical role in this comparison. States like Gujarat and Maharashtra have begun to attract investment in data centers and cryptocurrencies, so miners should consider local regulations, environmental factors, and the availability of hosting services. Moreover, participants in Indian cryptocurrency markets are at the crossroads of emerging tech, suggesting that miners should remain flexible and open to reassessing their strategies as functionalities and technologies evolve.

Another aspect worth noting in this dialogue is the disruptive advancements in mining technology. With the rise of Ethereum 2.0, the industry must grapple with shifts in mining currency dynamics. While Bitcoin miners predominantly rely on hardware-based mining rigs, the complexities of Proof of Stake for Ethereum underline the diversity within this realm. Miners must introspect not just on the method—self-mining versus hosted—but also on what currencies they plan to mine and the sustainability of their chosen method over time.

Ultimately, the decision between hosted and self-mining is substantially dictated by an individual’s financial, technical, and personal capabilities. Understanding the cost implications while balancing the demand for personal involvement in the mining process leads one to make an informed choice. As the Indian crypto market continues to mature, miners who adapt to these conditions—whether they opt for full ownership or shared responsibility—are likely to secure their place in this digital gold rush.

In conclusion, whether you are staring at the illuminated screens of a self-built mining rig or watching cryptocurrencies accumulate in the wallet linked to a hosting service, the journey into the world of Bitcoin and altcoins offers opportunities galore. This robust landscape, teeming with potential, requires keen understanding and adaptability to thrive, positioning both self-miners and hosted miners at the forefront of this thrilling technological revolution. With the right approach, the path to profitability is not merely a dream but an attainable reality.